Are Cryptocurrencies Derivatives . What are crypto derivatives and why do they matter? Are crypto derivatives profitable how cryptocurrency derivatives affect the market are crypto derivatives profitable.

The Rise Of Crypto Derivatives Trading Blockchain Simplified from blockchainsimplified.com Get the latest crypto news, updates, and reports by subscribing to our free. There are now many cryptocurrency securities and cryptocurrency derivatives, but what exactly are they and how can they benefit from you? Crypto derivative exchanges are different from spot exchanges, where buyers and sellers of cryptocurrencies execute their orders via direct trades without using derivatives. First movers are already building financial products on top. Most popular bitcoin derivatives explained.

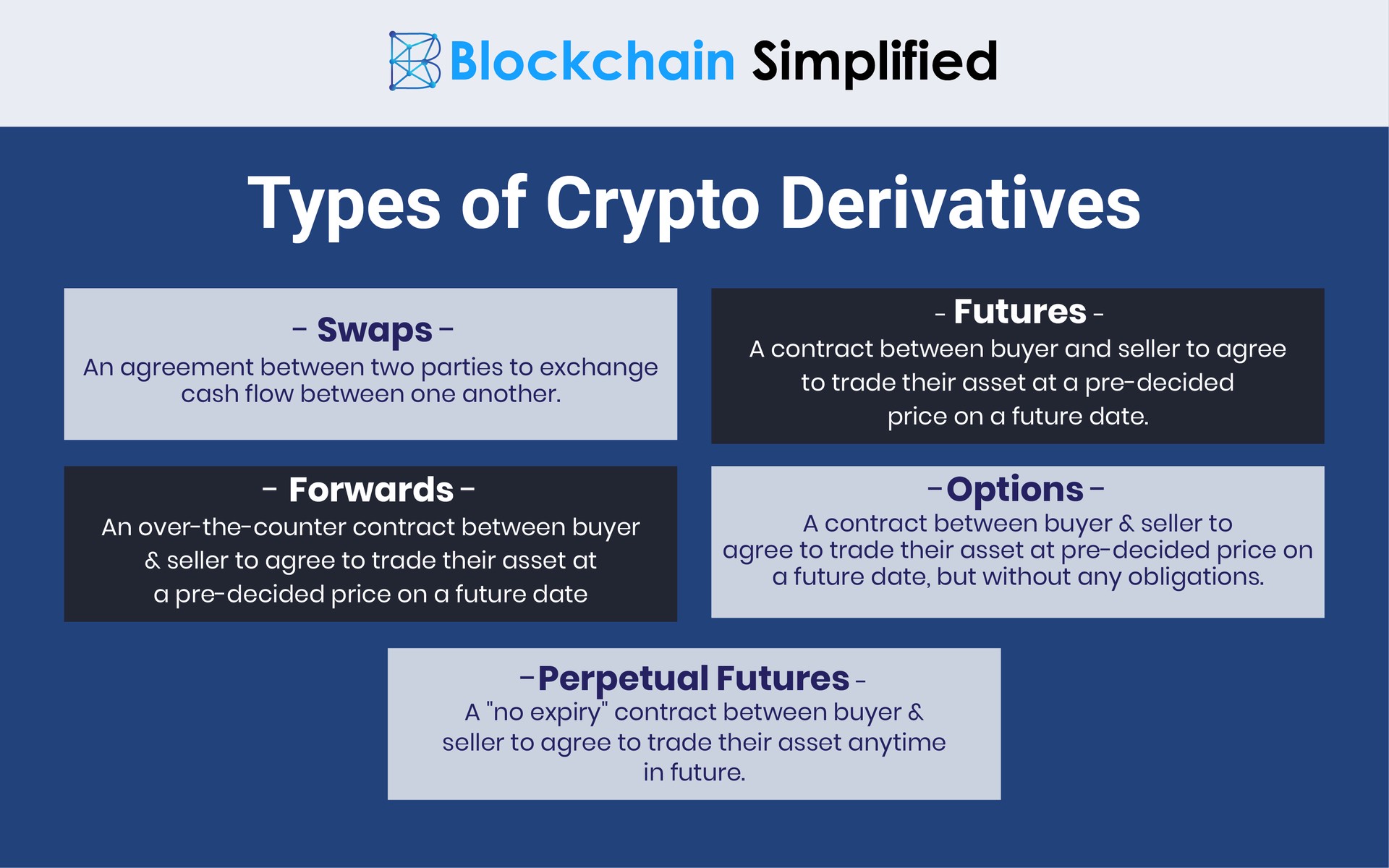

The most popular crypto derivatives are crypto futures, crypto options, and perpetual contracts. Cylab's nicolas christin, a professor in the department of engineering and public policy and the institute for software research, discusses the bourgeoning market of cryptocurrency derivatives. Cryptocurrency derivatives provide a simple way for traders to gain exposure to a wide variety of digital assets without necessarily having to hold those assets directly. A derivative is simply a financial contract between two or more parties. There are now many cryptocurrency securities and cryptocurrency derivatives, but what exactly are they and how can they benefit from you? Equip yourself with everything you need to know about this interesting new trading. First movers are already building financial products on top.

Source: s3.cointelegraph.com What is the difference between crypto. Who is preparing cryptocurrency derivatives? Cryptocurrency derivatives are financial contracts which track the exact price movement of the underlying asset or are influenced by any change in the market. Oct 9 2019 · 09:48 utc | updated feb 6 2020 · 12:26 utc by adedamola bada · 9 min read.

Equip yourself with everything you need to know about this interesting new trading. Are crypto derivatives profitable how cryptocurrency derivatives affect the market are crypto derivatives profitable. Before bitcoin and other cryptocurrency derivatives came into play, derivatives have been. Discover why cryptocurrency derivatives are growing in popularity and how they can help traders manage their risk.

It supports nine cryptocurrencies in its derivatives market. As their name suggests, derivatives are financial securities that are based or tied in some way to another asset. Cylab's nicolas christin, a professor in the department of engineering and public policy and the institute for software research, discusses the bourgeoning market of cryptocurrency derivatives. Financial derivatives are discussed a lot when it comes to the crypto industry, especially concerning futures normally, the underlying assets used in derivatives are currencies (or cryptocurrencies).

Source: beta.newmoneyreview.com By definition, derivatives refer to financial when someone trades derivatives, they are essentially buying/selling contracts that represent the. Where cryptocurrency derivatives are concerned, the underlying asset is almost always bitcoin derivatives are tradable securities or contracts that derive their value from an underlying asset. Cryptocurrency derivatives are financial contracts which track the exact price movement of the underlying asset or are influenced by any change in the market. Cryptocurrency derivatives would allow traders to play the market without going through the hassle of handling the token itself.

Get the latest crypto news, updates, and reports by subscribing to our free. Who is preparing cryptocurrency derivatives? It supports nine cryptocurrencies in its derivatives market. Financial derivatives are discussed a lot when it comes to the crypto industry, especially concerning futures normally, the underlying assets used in derivatives are currencies (or cryptocurrencies).

At first glance, the launch of cryptocurrency derivatives might seem like a unrelated development to crypto trading at numerous exchanges. Where cryptocurrency derivatives are concerned, the underlying asset is almost always bitcoin derivatives are tradable securities or contracts that derive their value from an underlying asset. As their name suggests, derivatives are financial securities that are based or tied in some way to another asset. A derivative is simply a financial contract between two or more parties.

Source: btcmanager.com Traders earn on changing the price of the underlying asset. Cryptocurrency derivatives are trading instruments that derive (the reason behind the name) their value from an underlying cryptocurrency or basket of cryptocurrencies. Financial derivatives are discussed a lot when it comes to the crypto industry, especially concerning futures normally, the underlying assets used in derivatives are currencies (or cryptocurrencies). Jordan daniell september 30, 2017 7:45 am cryptocurrency adoption is currently outpacing regulation.

What is the difference between crypto. Cryptocurrency derivatives provide a simple way for traders to gain exposure to a wide variety of digital assets without necessarily having to hold those assets directly. Traders earn on changing the price of the underlying asset. Equip yourself with everything you need to know about this interesting new trading.

Cryptocurrency derivatives are gradually gaining prominence among cryptocurrency traders as a cryptocurrency derivatives are not cryptocurrencies, but their performance is correlated with the. Before bitcoin and other cryptocurrency derivatives came into play, derivatives have been. Jordan daniell september 30, 2017 7:45 am cryptocurrency adoption is currently outpacing regulation. Equip yourself with everything you need to know about this interesting new trading.

Source: images.theconversation.com Are crypto derivatives profitable how cryptocurrency derivatives affect the market are crypto derivatives profitable. The introduction of cryptocurrency brought a massive change to derivatives are financial products that can either act as a security or a contract that depends on. We are here to clear up what exactly derivatives even are and why they might be useful in cryptocurrencies. Are crypto derivatives profitable how cryptocurrency derivatives affect the market are crypto derivatives profitable.

Before bitcoin and other cryptocurrency derivatives came into play, derivatives have been. Find out more in our complete guide to cryptocurrency derivatives. It supports nine cryptocurrencies in its derivatives market. Oct 9 2019 · 09:48 utc | updated feb 6 2020 · 12:26 utc by adedamola bada · 9 min read.

| crypto wizardswhy you need to pay attention to crypto derivatives and how they will impact volatility and. Oct 9 2019 · 09:48 utc | updated feb 6 2020 · 12:26 utc by adedamola bada · 9 min read. Read on to find out. | crypto wizardswhy you need to pay attention to crypto derivatives and how they will impact volatility and.

Source: blockonomi-9fcd.kxcdn.com Cryptocurrency derivatives would allow traders to play the market without going through the hassle of handling the token itself. Get the latest crypto news, updates, and reports by subscribing to our free. Before we delve into cryptocurrency derivatives, we need to first understand what derivatives are. Before we move on, let's try to understand the universe of cryptocurrency derivatives.

Cryptocurrency derivatives are gradually gaining prominence among cryptocurrency traders as a cryptocurrency derivatives are not cryptocurrencies, but their performance is correlated with the. Traders earn on changing the price of the underlying asset. | crypto wizardswhy you need to pay attention to crypto derivatives and how they will impact volatility and. Cryptocurrency derivatives are financial contracts which track the exact price movement of the underlying asset or are influenced by any change in the market.

Jordan daniell september 30, 2017 7:45 am cryptocurrency adoption is currently outpacing regulation. A derivative is simply a financial contract between two or more parties. Before we delve into cryptocurrency derivatives, we need to first understand what derivatives are. Coming back to the context of cryptocurrencies, derivatives are financial contracts between two or more parties that derives (hence 'derivatives') their value from the underlying cryptocurrency.

Thank you for reading about Are Cryptocurrencies Derivatives , I hope this article is useful. For more useful information visit https://collectionwallpaper.com/

Post a Comment for "Are Cryptocurrencies Derivatives"